Hard Money Loans Things To Know Before You Buy

Table of ContentsLenders Near Me - The FactsThe 4-Minute Rule for Hard Money Loan10 Easy Facts About Commercial Loans ShownHard Money Loans Fundamentals Explained6 Simple Techniques For Hard Money LendersHow Private Money Lenders can Save You Time, Stress, and Money.

Some of the deals on this page might not be available with our website. Offer pros and disadvantages are figured out by our content group, based on independent research study. The financial institutions, loan providers, as well as bank card companies are not liable for any type of material published on this site as well as do not endorse or assure any testimonials.This compensation may affect exactly how, where, and also in what order the products appear on this website. The offers on the site do not stand for all available financial services, firms, or products. * For total details, see the offer terms and conditions on the provider or partner's site. Private Money Lenders. Once you click use you will certainly be guided to the provider or partner's site where you might review the conditions of the offer before using.

2022 All civil liberties scheduled. Experian. Experian and the Experian hallmarks made use of herein are trademarks or signed up hallmarks of Experian and its associates. Using any other profession name, copyright, or trademark is for identification as well as referral objectives only and does not suggest any organization with the copyright or hallmark owner of their item or brand name.

Lenders Near Me Fundamentals Explained

Why make use of hard cash? There are a number of distinctive advantages to funding your property project with a difficult cash car loan: Difficult cash loan providers focus more on the security and less on your individual financial scenario. They're also not bound by the exact same regulations as well as regulations as financial institutions, so they can provide rapid turn-arounds for authorization and also financing closing.

Since, again, a tough cash finance is funded by an exclusive loan provider as well as backed by actual realty, numerous difficult money lending institutions will purchase jobs and also customers that significant banks won't. If your credit report is recouping, for example, a hard money lender can pick to fund your funding, also if a bank can't.

Some Of Lenders Near Me

Tough cash financings have short lifespansusually 12 to 18 months. The brief period as well as high interest rates think that the car loan will be paid off within 2 years, which is generally done by selling the residential property or protecting a conventional home loan for a primary home.

Due to the fact that tough money finances are not managed the way conventional finances are, terms and also requirements differ from one loan provider to see here the following. If you're considering a hard money loan, make certain to find the very best loan provider. Precision Capital. Neighborhood hard cash lenders are typically a lot more versatile as well as simpler to work with than national lenders.

Discover a difficult cash lending institution with a good reputation. Get to out to a couple of tough cash lending institutions in your location and see what they have to supply.

4 Simple Techniques For Lenders Near Me

Content Freedom, We want to help you make even more informed choices (Private Money Loans). Some web links on this page clearly marked may take you to a partner site as well as might cause us earning a referral compensation. For more details, see Everybody likes a great episode of HGTV, however the art of home flipping is difficult to master.

Go into: tough cash financings. When you can't or do not intend to experience a typical lending institution, a tough money funding can be a choice. Planned for home fins and investor, these temporary financings are typically underwritten based upon the home being made use of as collateral, instead of your debt.

Here's what you must recognize around difficult money prior to authorizing on the populated line. A hard cash lending, often called a rehab lending, is a kind of loan backed by a "difficult" asset, where the security is assessed instead of the consumer's monetary profile. Residence flippers will certainly frequently utilize this kind of financing to secure short-term financing for remodellings.

The Basic Principles Of Private Money Lenders

You wish to get your money in and also your money out," says Leslie H. Tayne, Esq., debt lawyer as well as the founder of Tayne Law Team, P.C.There are temporary, traditional financings, such as rehab or fix-and-flip fundings, which have an extensive underwriting process that might take weeks or months for authorization.

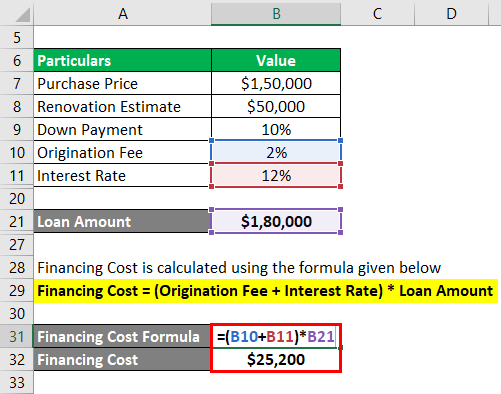

It's an usual circumstance with house fins, however you don't desire to be blind-sided if your tough money lender does not supply extensions. Tough cash is extra pricey than a traditional financing. Passion rates are higher, and also you'll additionally have to make a deposit and also pay potential origination and also appraisal charges.

The 6-Second Trick For Hard Money Loan